Inflation is one of the most important economic phenomena affecting the value of money over time. When we talk about our savings, it’s crucial to understand how different strategies can protect or increase our capital, especially in a context where the value of money is constantly changing.

The silent loss generated by inflation is perhaps one of the most underestimated aspects of financial planning. When money is kept without generating returns, inflation constantly erodes its purchasing power. A $100 bill today will buy fewer goods and services in the future, and this loss is more significant than many imagine. With 5% annual inflation, purchasing power is reduced by approximately half in 14 years. This reality turns static money into a declining asset.

To maintain the real value of money over time, we need to obtain a return that at least equals the inflation rate. If inflation is 5%, we need an investment that generates at least that same annual percentage to maintain constant purchasing power. However, maintaining real value is just the starting point; the true objective should be to increase our purchasing power over time.

Simple interest represents the most basic form of financial growth, calculated only on the initial capital. For example, if we invest $10,000 at 8% annual simple interest, each year will generate $800 in interest, regardless of interest accumulated in previous years. Although it’s better than generating no returns, simple interest significantly limits the growth potential of our capital.

Compound interest, on the other hand, represents the most powerful form of financial growth, as it generates returns not only on the initial capital but also on accumulated interest. This multiplier effect creates exponential growth that Albert Einstein supposedly called “the eighth wonder of the world.” With compound interest, each investment cycle builds on previous returns, creating a snowball effect that can transform modest amounts into significant sums over time.

Understanding and applying these fundamental concepts is essential for any financial survival strategy in the modern era. It’s not just about saving money, but understanding how to make it work effectively against the erosive forces of inflation and in favor of the power of compound interest. This understanding forms the basis for more informed financial decisions and more effective investment strategies.

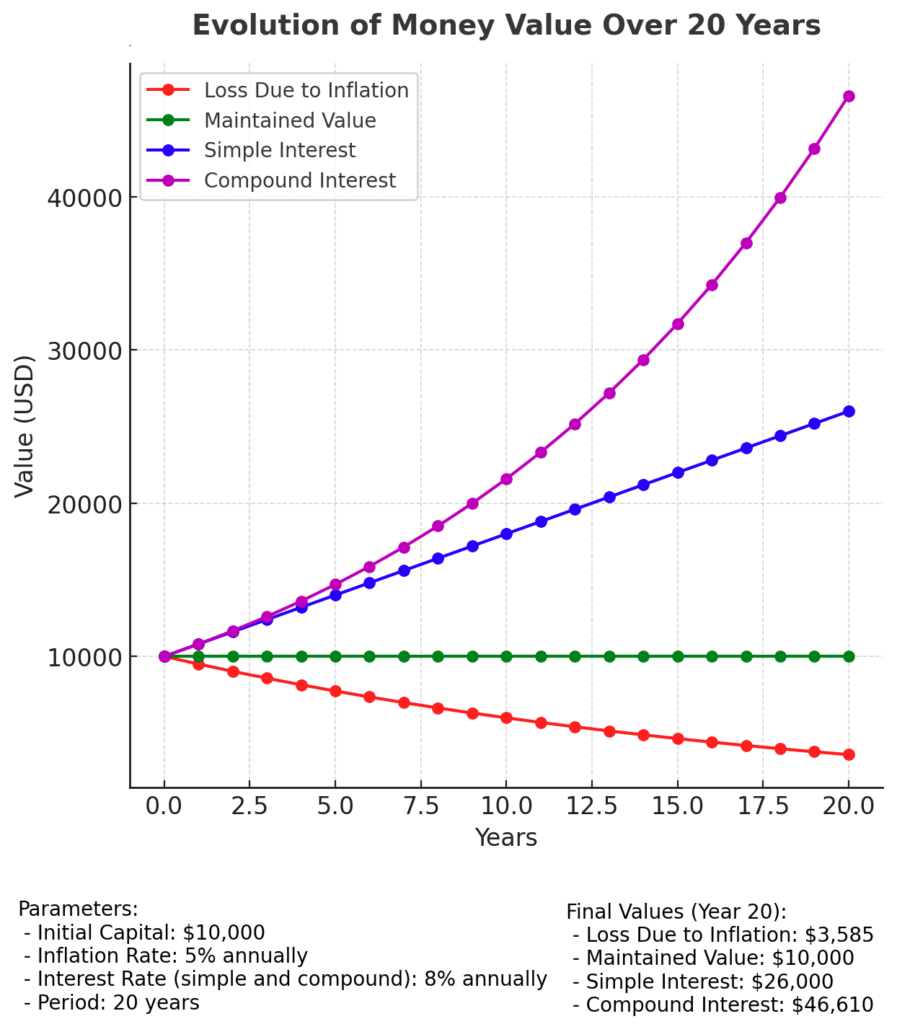

To illustrate the dramatic impact that different financial strategies can have on our capital, let’s consider the evolution of an initial capital of $10,000 over a 20-year period under different scenarios.

- Loss due to inflation: in the most basic scenario, where money remains static and is exposed to inflation, the real value depreciates significantly until reaching an equivalent of $6,415, representing a loss of $3,585 in purchasing power. This silent loss demonstrates the real cost of keeping money “under the mattress” or in accounts without returns.

- Maintained value: when we achieve a return that equals the inflation rate, we at least manage to keep the real value of our money constant. Although this is preferable to losing value, it doesn’t really help us build long-term wealth.

- Simple interest: the situation improves considerably when we apply simple interest above inflation. With 8% simple interest, for example, the value grows steadily until reaching $26,000 after 20 years, almost tripling the initial capital. This linear growth represents a significant improvement over previous scenarios.

- However, the true power of financial growth is revealed with compound interest. Using the same percentage of 8%, but applied in compound form, the capital grows exponentially until reaching $46,610 after 20 years, multiplying the initial investment by almost five times. This dramatic difference illustrates why compound interest is considered one of the most powerful forces in personal finance.

It’s crucial to understand that these principles are not limited to large initial investments. The same dynamics apply to periodic investment strategies, where regular contributions are made, whether monthly or annually. A person who doesn’t have large initial capital can build a solid financial foundation through consistent contributions of $100, $500, or $1,000 monthly. In fact, periodic investment combined with compound interest can be an even more powerful long-term strategy, as it takes advantage of both the power of time and the discipline of regular savings.

The lesson is clear: for those seeking not only to preserve but to multiply their capital, a strategy based on compound interest is the most effective path. Time becomes our ally, and the sooner we begin, the greater the benefit of exponential growth.